bain capital tech opportunities fund ii lp

It is now ahead of its 1 billion target reported last October by Buyouts. Street Address 1 Street Address 2.

Bain Capital S New Technology Fund Makes Maiden Investment Wsj

The current minimum investment for Bain Capital Asia Fund Iii LP is 10000000.

. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year. Bain Capital Distressed Special Situations 2013 A2 Master LP. Management has no ownership stake in the fund.

Bain Capitals second Tech Opportunities fund is targeting 15 billion for investments in mid-market buyouts and late-stage growth for control and minority transactions. 0 percent of the fund is owned by fund of funds. Fund II will focus primarily on North American companies and pursue investments in technology including application software infrastructure and security fintech and.

Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live. The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to. Ad Explore our state-of-the-art investment marketplace for free.

Bain Capital Distressed Special Situations 2019 B Master L. Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live. Columbia St Covington LA 70433 Partnership Audubon Capital Partners II LLC.

Bain Capital which manages more than 100 billion is planning to raise 1 billion for a tech-focused fund that will invest in takeovers. Bain Capital Tech Opportunities LP is a Delaware Domestic Limited Partnership filed On May 30 2019. The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to.

We draw upon a senior team with industry venture capital public equity and private equity investing experience. Bain Capital Fund Xi LP. End Ave Suite 33-F New York NY 10280 Partnership Celestial Advisors GP I LLC Audubon Capital Fund II LP.

The Bain Capital Tech Opportunities Fund LP is targeting up to 1 billion to make control and late-stage growth investments in midmarket tech deals. Since our founding in 1984 weve applied our insight and experience to organically expand into several asset classes. Bain Capital Asia Fund Iii LP is one of the larger private funds.

City StateProvinceCountry ZIPPostalCode Phone Number of Issuer. 0 percent of the fund is owned by fund of funds. Benefit from sizable tax advantages by investing in Qualified Opportunity Funds.

Is one of the larger private funds with. While Bain Capital appears to have met the target for its new technology offering the firm has not yet held a final close according to person with knowledge of the matter as as reported by sister title Buyouts. Bain Capital Fund Xi LP.

Bain Capital Asia Fund Iii LP is a private equity fund operated by Bain Capital Private Equity Lp and has approximately 32 billion in assets. Respondent Bain Capital Fund XI LP is a limited partnership organized existing and doing business under and by virtue of the laws of the Cayman Islands with its executive offices and principal place of business located at 200 Clarendon Street Boston MA. The Registered Agent on file for this company is Maples Fiduciary Services Delaware Inc.

Bain Capital Distressed Special Situations 2019 B Master LP. And is located at 4001 Kennett Pike Suite 302 Wilmington DE 19807. Management has no ownership stake in the fund.

Partnership Alphadyne Capital LLC general partner Aquila Technology Opportunities Fund LP co Celestial Advisors GP I LLC 375 S. We combine deep domain expertise with the ability to tap the global reach insight and relationships of the broader Bain Capital platform across the entire technology ecosystem. The current minimum investment for Bain Capital Fund Xi LP.

While Bain Capital appears to have met the target for its new technology offering the firm has not yet held a final close a person with knowledge of the matter told Buyouts. Invest in Funds That Received Top Ratings From a Leader in Independent Investment Research. Sign up and browse today.

The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to David Lee the director of private equity for the council which manages 34 billion of assets for four permanent funds. Ad The Fund Seeks to Provide Long-Term Capital Growth. The team combines deep domain expertise with the ability to tap the global reach insight and relationships of the broader Bain Capital platform across the.

Is a private equity fund operated by Bain Capital Private Equity Lp and has approximately 77 billion in assets. Since our founding in 1984 weve applied our insight and experience to organically expand into. Bain Capital Tech Opportunities Fund LP.

The companys filing status is listed as Active and its File Number is 7443111. Bain Capital is an American private investment firm based in Boston MassachusettsIt specializes in private equity venture capital credit public equity impact investing life sciences and real estateBain Capital invests across a range of industry sectors and geographic regions. Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live.

Bain Capital Tech Opportunities Fund secured 107 billion according to a regulatory documentIt is now ahead of its 1 billion target reported last. Bain Capital Tech Opportunities Fund secured 107 billion according to a Form D fundraising document. Bain Capital is committing 150 million to the fund Mr.

Bain Capital Tech Opportunities pursues investments in application software fintech and payments healthcare IT and infrastructure security. Bain Capital Distressed Special Situations 2013 A2 Master L. Since our founding in 1984 weve applied our insight and experience to organically expand into.

As of 2022 the firm managed more than 155 billion of investor capital.

Bain Capital S New Technology Fund Makes Maiden Investment Wsj

About Us Bain Capital Private Equity

Industries Bain Capital Private Equity

Bain Capital Hits Target For Tech Fund With Nearly 1 1bn Plans To Keep Raising Venture Capital Journal

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

Athenahealth Acquired By Hellman Friedman And Bain Capital Business Wire

Our People Bain Capital Tech Opportunities

Bain Capital Targets 1 5 Billion For Second Tech Opportunities Fund Mint

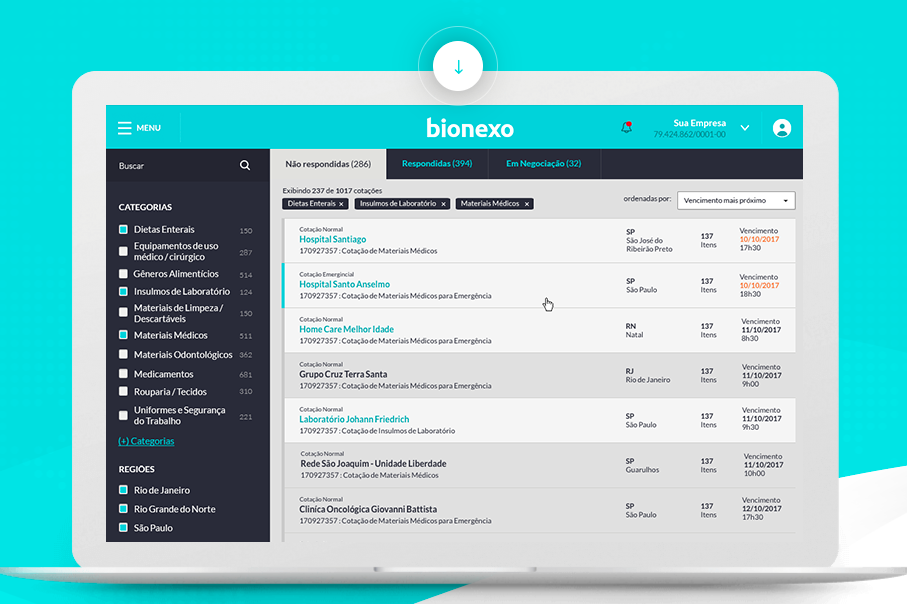

Bionexo Announces R 450 Million Investment From Bain Capital Tech Opportunities Bain Capital

Bain Capital Tech Opportunities General Partner Llc

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

When I Work Secures 200 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

Our People Bain Capital Tech Opportunities

Bain Capital Hits Target For Tech Fund With Nearly 1 1bn Plans To Keep Raising Buyouts

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Bain Capital Targets 1 5bn For Second Tech Opportunities Fund Private Equity Insights

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments